FEBRUARY 6, 2023

By Brian O’Connell

Buyers who wait for more inventory, lower interest rates or something else may never own a home. And given history, 2023 is a pretty good year to commit.

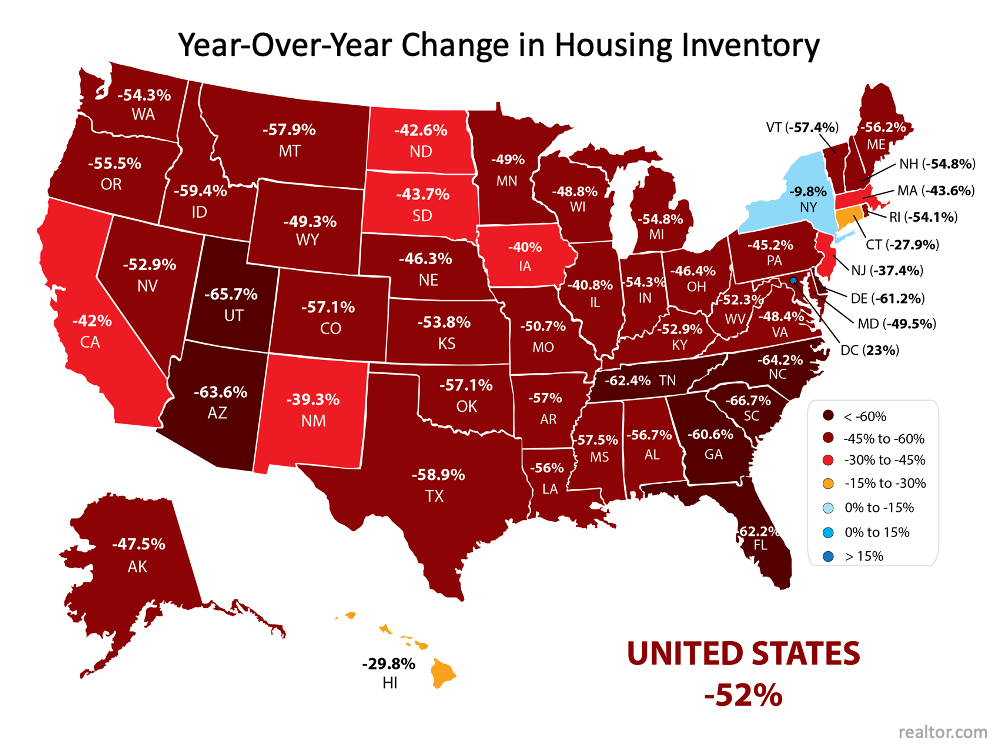

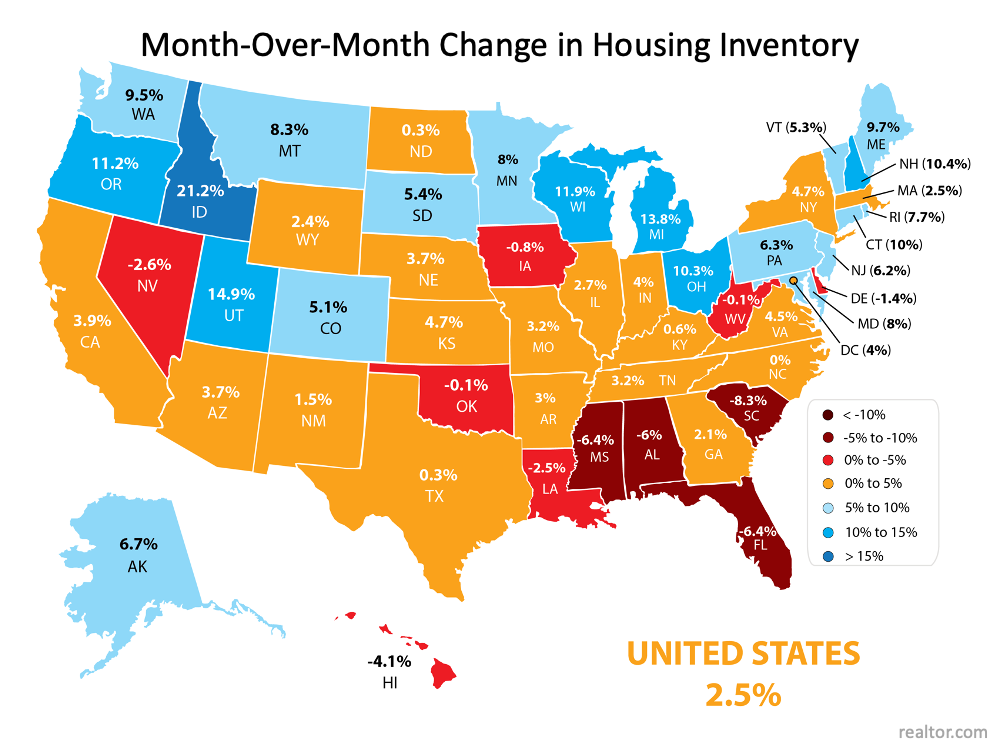

McDONOUGH, Ga. – Mortgage rates are finally falling across the fruited plains, with rates in the 5.6% range for a 30-year fixed mortgage not uncommon in early February. Couple that with declining home prices and an uptick in the residential real estate inventory, and it looks like the great American homebuyer finally has leverage after two years of home sellers calling the shots.

“2023 will be better for buyers,” said Magellan Realty LLC mortgage broker Alex Caras. “As the Federal Reserve keeps interest rates at the current levels, the buying market will start to open up more, reducing competition for existing homes.”

Construction woes brought on by the supply chain issues are also being eased, “so more new homes will be on the market,” Caras added.

Buyers getting an edge

Those are the macro reasons why U.S. homebuyers have a leg up going into the busy spring and summer real estate season. Buyers should have an edge thanks to these five realities, as well.

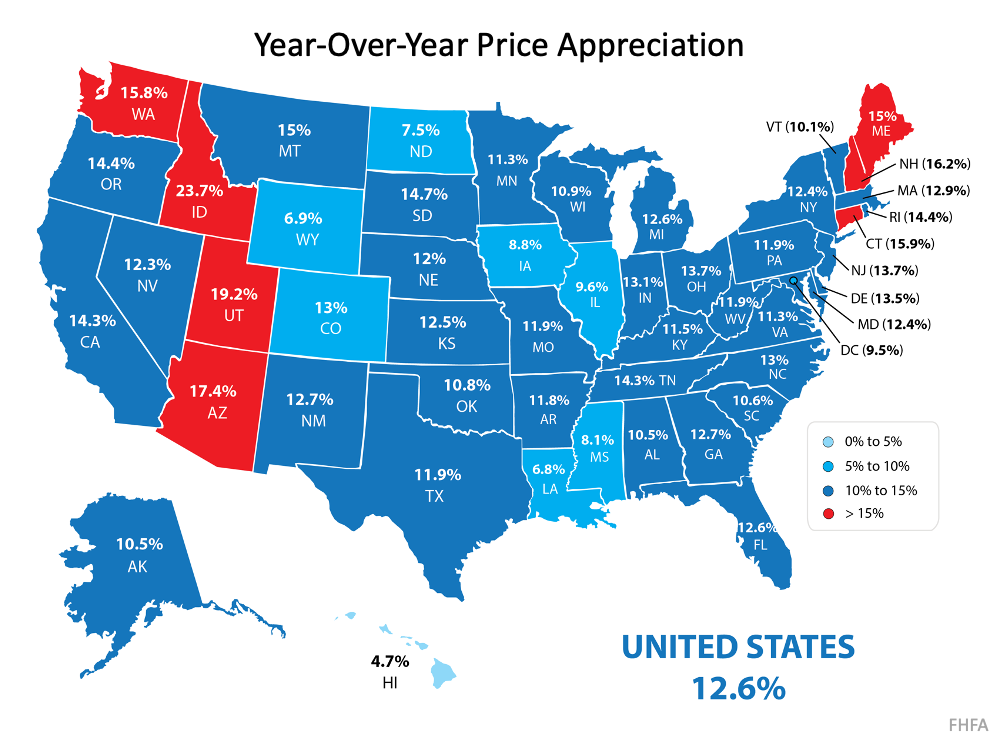

1. Mega-high prices are a thing of the past. “The price climbing we saw in 2020 and 2021 has hit a plateau,” said Guaranteed Rate Mortgage Senior Vice President of Lending Jennifer Beeston. “It took a good chunk of 2022 for many sellers to realize 2021 is long gone and they needed to be more realistic with the pricing and condition of their home.”

In addition, buyers see a return to a more balanced market in 2023. “Now, buyers actually can get inspections and can negotiate prices,” Beeston said. “That wasn’t the case with the drama of 2022.”

2. The Federal Reserve is hitting the brakes. The U.S. Federal Reserve is slowing down its policy of substantial interest rate increases that were prevalent in 2022.

“This means more buyers will be able to purchase a home at a lower rate,” Caras told TheStreet. “Home prices have been reduced to a more reasonable level as well, and this will continue for much of 2023 as the competition to purchase homes has lessened.”

3. The pandemic is over. Buyers will have an opportunity to negotiate again in 2023 and even more so in 2024.

“We’re likely going to see some distressed sales and sellers will need to become more realistic,” said Pulse International Realty founder Rena Kliot. “The spike in home prices is not sustainable and was in direct correlation to the pandemic. During the dark days of the pandemic, there were many desperate and emotional purchases.”

4. Changing residential market tastes. While single-family homes will continue to be popular, the U.S. condo market will return in full swing.

“Life as we knew it seems to be returning and that is drawing people back to urban dwelling – especially with condo living,” Kliot said. “Condo prices are now also more affordable or negotiable than single-family residences.”

5. Strong signals from the stock market. Across the U.S., there seems to be a general sigh of relief the worst has passed.

“Inflation has peaked, interest rates have peaked, and home prices have peaked for now,” said Elegran Real Estate managing director Jared Antin. “The stock market – notably the tech-heavy NASDAQ – has seen a significant rebound thus far in 2023, which instills a certain level of confidence in the consumer.”

The falling market through much of 2022 had the opposite effect, reducing consumer appetite for a new home with rising interest rates and inflation.

“Now, a more positive consumer base will help fuel a rebounding real estate market,” Antin noted.

One of the most important things a would-be home buyer should do right now is to stay hopeful and be prepared.

“Don’t assume that just because you’re having trouble finding a home now, or can’t afford a house at today’s rates, that you’ll never be a homeowner,” LendingTree senior economist Jacob Channel. “If you have patience and are willing to compromise on some things, like how many bathrooms your house needs to have or what specific neighborhood you require, you can make your dream of homeownership a reality.”

Additionally, being prepared financially when a good deal arises is critical right now.

“Be diligent about saving money and make all of your monthly payments on time to protect your credit,” Chanel told TheStreet. “Also, shop around and compare mortgage offers from different lenders or look into different mortgage loan programs – like FHA or USDA backed loans – so you can make the home buying experience more affordable.”

Copyright © 2023 Henry Daily Herald. All rights reserved.

![Experts Agree: Options Are Improving for Buyers [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/07/15150442/20210716-MEM-1046x1908.png)